The Eurasian Economic Union (EEU) is an economic union of states which was established on May 2014 by the leaders of Belarus, Kazakhstan, and Russia, and came into effect on January 1, 2015.

The Eurasian Economic Union (EEU) is an economic union of states which was established on May 2014 by the leaders of Belarus, Kazakhstan, and Russia, and came into effect on January 1, 2015.

Armenia joined on January 2, 2015 and Kyrgyzstan joined on August 6, 2015.

In 1994, the President of Kazakhstan first suggested the idea of creating a regional trading bloc. Numerous treaties were subsequently signed to establish the trading bloc gradually. Many politicians, philosophers, and political scientists have since called for further integration towards a political, military and cultural union; however, Kazakhstan has insisted the union stay purely economic.

Tajikistan has been invited to join the union and membership negotiations are underway.

Uzbekistan was hesitant to join the Economic Union; however, Uzbekistan began negotiation when Russia announced it would write off $865 million off debt owed by the country to Russia if Uzbekistan joins EEU. Turkey was also extended an invitation to join the EEU by Kazakhstan’s President.

Ukraine past president Viktor Yanukovych’s decision to abandon an association agreement with the European Union and exclusively pursue integration with the EEU was a key factor in triggering the protests that ended his term as president of Ukraine. The country’s membership in the EEU was seen by some analysts as the key to the success of the union as Ukraine has the second largest economy of any of the former Soviet Union republics. The union is significantly more unattractive and even less viable than it was first conceived by not having Ukraine as a member, which undermines the economic and trade potential of the union. In addition, the impact of Western sanctions on the Russian economy lessens the value and viability of the union. Moreover, in the wake of the fall in the value of the Russian ruble and the decline in world oil prices, Russia is no longer the economic powerhouse it was once.

The Eurasian Economic Union is designed to reach a number of macroeconomic objectives such as reducing commodity prices by reducing the cost of transportation of raw materials, increasing return on new technologies and products due to the increased market volume. It is also designed to lower food prices, increase employment in industries and increase production capacity.

The Eurasian Economic Union has approximately 175 million people and a gross domestic product of over $4 trillion. The EEU requires the free movement of goods, capital, services, and people as well as provides for common transport, agriculture, and energy policies, with provisions for a single currency and greater integration in the future. The EEU institutions are the Eurasian Commission (the executive body), the Court of the EEU, and the Eurasian Development Bank.

Eurasian Development Bank

The mission of the Eurasian Development Bank is to facilitate the development of market economies, economic growth and the expansion of trade among the member states through investments. The bank’s objectives also include financing projects that support Eurasian integration.

Court of the Eurasian Economic Union

The Court of the Eurasian Economic Union is in charge of dispute resolution and the interpretation of the legal order within the Eurasian Economic Union. Its headquarters is in Minsk. The court is composed of two judges from each member state, appointed by the heads of government of the member states. Their term of office is nine years.

Budget

The approved budget of the Eurasian Economic Union for 2015 is 6.6 billion Russian Rubles. The budget is formed from contributions by the union’s member states.

Internal market

The core objective of the Single Economic Space is the development of a single market and achieving the “four freedoms”, namely the free movements of goods, capital, services, and people within the single market. The four freedoms came into effect on January 1, 2015. The free movement of people means that citizens can move freely among member states to live, work, study, or retire. Citizens of the member states of the union may travel to other member states on an internal passport.

Energy

The EEU is producing approximately 21% of the world’s natural gas and 15% of oil and gas. It also produces 9% of the world’s electrical energy and 5.9% of coal, making it the third and fourth producer in the world, respectively. Russia has the world’s largest natural gas reserves, the 8th largest oil reserves, and the second largest coal reserves. Russia is also the world’s leading natural gas exporter and the second largest natural gas producer.

Infrastructure

Railways have been the primary way of linking countries in the EEU since the 19th century. The union ranks 2nd in the world in terms of railway.

Agriculture

The EEU is the top producer of sugar beet and sunflower, producing 19% of the world’s sugar beet and 23% of the world’s sunflowers in 2012, as well as a top producer of rye, barley, buckwheat, oats and sunflower seed. It is also a large producer of potatoes, wheat and grain.

Economic Statistics of Armenia in 2015

In determining effects of joining EEU, it will be beneficial to look at the trend of various economic indicators. Armenia’s foreign trade in the first seven months of 2015 was down by almost 20% to $2.6 billion, according to the latest numbers in accordance to the National Statistical Service (NSS). Data also shows that exports in January-July 2015 were approximately $847 million, which was approximately same as the same period in 2014, while imports fell by 27% to about $1.8 billion. Armenia’s trade with former Soviet Union countries fell by 16% to approximately $766 million, while trade with Russia was lower by 14% to $653 million; trade with Ukraine fell by 34% to $74 million, and trade with Belarus declined by 11% to about $18 million. At the same time trade with EU countries in January-July 2015 amounted to about $696 million, a decline of 26%, and trade with other countries dropped by 18% to $1,194 million.

In the first seven months of 2015, the export of mining industry products grew by 24% to about $268 million, export of finished food products declined by 14% to $155 million, and export of basic metals and products fell by 20% to about $143 million. Also, imports of mining industry products fell by 24% to about $373 million, import of machinery, equipment, and mechanisms slashed by 30% to $224 million, and import of finished food products declined by 14% to $154 million. International reserves formed $2.5 billion in 2012 but they are less than $1.5 billion in 2015, which is a decline of 40%. The GDP formed $10.3 billion in 2014 but it is estimated that it will not exceed $9.3 billion in 2015, which is a decline of 10%. External debt formed $4.3 billion in August 2013 but in mid 2015 it was $4.7 billion.

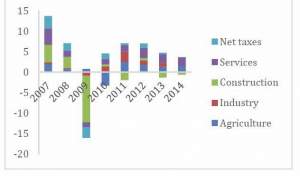

Economic Growth by Sector

The recent oil price shock and Western sanctions have battered the Russian economy and undermined growth prospects. The slowdown in Russia affects Armenia through foreign trade, remittances, and foreign investment. Russia is the destination for close to 25% of Armenia’s exports and the source of 40% of its foreign investment, as well as 80–90% of its remittances.

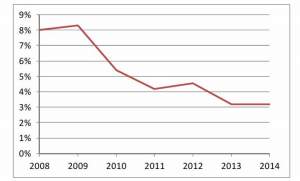

Foreign direct investment percent of GDP

EEU economic implications for Armenia

More than three million Armenians live and work in Russia and other EEU member countries trying to somehow meet the needs of their families in Armenia. Therefore, many Armenians back membership in the EEU, but there are also those who speak in favor of close cooperation with the European Union.

The most serious and immediate impact on Armenia’s economy is the need to adjust both its tariff rates and its trade orientation. The open and liberalized Armenian economy must adopt the higher tariffs and more protectionist policies of the other EEU members. This move may spark price increases, but will also mandate a serious renegotiation over Armenia’s membership in the World Trade Organization (WTO). Several years of an EU-dominated direction of trade will have to be adjusted and Armenia has to adapt to the markets of Russia, Belarus, and Kazakhstan.

One of the economic benefits for Armenia will be the allocation of customs duties and tariff revenues among the member states. However, Armenia’s share will be only 1.13% of the EEU’s total customs revenue. Since January 2015 Armenia has begun to receive customs duties from the EEU distribution which contributed to the 6.2% growth of revenues from customs duties for the first quarter of 2015.

The EEU regulations may also affect the expansion of one of Armenia’s most important and fastest-growing sectors. The Armenian information technology (IT) sector accounted for roughly one-third of exports in 2013, and about 5% of the country’s GDP, up from 1.7% in 2010. The IT sector expanded by 25% in 2014, with a combined output from some 400 IT-related firms totaling nearly $475 million. But because much of the Armenian IT sector relies on investment from the United States, the new IT-related rules and poor intellectual property rights of the EEU and its members could adversely impact this strategically significant sector.

It is much more promising to cooperate with countries with more developed economies, but the European Union is not going to be a market for lower quality goods made in Armenia. Exporting to advanced countries requires that companies continually improve technology to stay competitive. The adverse effects of EEU accession could lower Armenia’s ability to upgrade products and move up the value chain because of the diversion of trade from the sophisticated EU markets to the less sophisticated members of the EEU.

Armenia could attract considerable interest for market-seeking foreign direct investment because its investment climate is more attractive than those of other EEU members. Investors could use Armenia as a base to access the wider EEU market. If these investors could bring technology and know-how to Armenia, that would compensate for the disadvantages of the trade diversion.

Armenia can expect economic gains because customs-free access opens wide opportunities to a market of 175 million consumers. The country’s single most important import partner is Russia, with about as many goods arriving from Russia as from all the countries in the EU. Russia is also a major receiver of export from Armenia, but as a group EU members buy about 30% more from Armenia than Russia does.

Armenia imports more technologically advanced goods from the EU but more energy and basic goods from Russia. While exports to the EU consist mostly of metals and minerals, Russia is the destination for higher-value-added goods, such as processed food and manufactured items. There is a small but rapidly growing high-tech export of both goods and services to Europe and the U.S. from Armenia’s information technology sector.

Armenia negotiated a number of concessions related to EEU accession: (1) Russia granted a unilateral waiver of export duties on natural gas, oil products, and unpolished diamonds. This had an immediate positive impact on external trade and mitigated poverty pressures; (2) Armenia started benefiting from higher proceeds from customs duties, as it receives 1.13% of the total pool of EEU customs revenues; and (3) Armenia obtained transition periods for harmonizing its tariffs to higher EEU levels for over 800 types of goods, which allows for smoother adjustment to the new trade regime for Armenian businesses.